Does QuickBooks Offer Project Management?

No, but you can track job costs and profitability. Here’s how. QuickBooks does an excellent job of tracking the sale of individual products and services. We’ve previously written about the process of creating item records in the software and having them available in lists when you create transactions. QuickBooks’ reports can then tell you whether you’re making or losing money on individual items–and on your sales as a whole. But your small business may need more complex tracking. Do you sell products and services together as part of a larger project? If so, you probably want to keep a running tally of the costs and income assigned to each project. That way, you can ensure that everything is billed to the appropriate customers, and you’ll be able to gauge the profitability of each.

QuickBooks doesn’t refer to these as projects, and it doesn’t have real project management tools. But it allows you to set up Jobs associated with individual customers. Even if you only anticipate having one job for a customer, you should set it up separately from the customer record so its income and expenses don’t get tangled up with the customer’s other transactions. QuickBooks also has specialized reports that can tell you whether you’re making a profit on each job. Here’s how the software manages these tools.

How Do You Create Jobs?

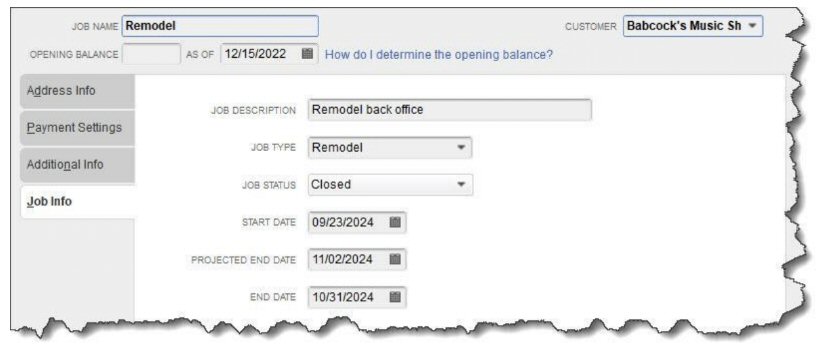

To get started, open the Customers menu and click Customer Center. Click on the name of a customer for whom you want to create a new job. In the upper left corner, click the down arrow in the New Customer & Job field, then click Add Job to open the New Job window. You’ll see a record template with a field at the top labeled JOBNAME. Type in a descriptive name that you’ll remember, then click the fourth tab down labeled Job Info.

You can enter some descriptive information for each job you create.

Complete as many fields as you can for the job. For JOB TYPE, you can create a list that fits your business by clicking the down arrow in that field and selecting <Add New>. For the builder in this example, you might have Remodel, New Construction, Repairs, and Overhead. Click OK when you’re done. You’ll now be able to assign income and expenses to that job.

What Transactions Can You Assign to Jobs?

Let’s look at how you can record jobs in your daily QuickBooks work.

Billable time

If you or your employees do work for a customer’s specific job, you need to make sure you enter it correctly. This applies whether you’re entering time as an individual activity or on a timesheet. Select the correct CUSTOMER: JOB and mark the time as billable.

Job-related purchases

When you have to buy something to use in a job, record it as a bill, a check, or credit card purchase and assign it to the appropriate CUSTOMER: JOB.

Mileage

Are you going to bill customers for mileage? Or maybe you just want to keep track of it for your own records. QuickBooks can help you track your costs for this, but it’ll take some time to get set up. Open the Company menu and select Track Vehicle Mileage. When that window opens, click the down arrow next to Manage in the upper right and select Vehicle to set it up before you start entering trips. This process is fairly self-explanatory, but we can help if you run into problems.

Estimates

If you enter your job-related estimates in QuickBooks, you’ll be able to access a comprehensive set of job cost reports, which will help you determine whether your project budget is on track. This allows you to assess the accuracy of your estimates and make necessary adjustments for future projects. To do this, simply create an estimate like you normally would (Customers | Create Estimates) and assign it to the correct job.