How QuickBooks Can Get Your Finances In Order for 2023

Put 2022 behind you by wrapping up those unfinished accounting tasks in QuickBooks.

You meant to clean up your accounting data by the end of 2022, but December is so busy. It was hard to do much beyond managing each day’s high-priority QuickBooks work. You’d catch up in January, you told yourself in December.

Now that it’s January, it’s time for a fresh start in a lot of ways, including your bookkeeping. But you can’t look ahead very effectively if you’re not sure where you are now. We recommend you take stock of the state of your QuickBooks company file. Are you caught up on bills? Do customers need to be invoiced? Are any of them past due on their payments to you?

QuickBooks is great at customer and vendor management, transaction processing, and reports. It can also serve as a barometer of your overall financial health. Let’s take a look at what you can do to update your company file and get ready for the challenges coming in 2023.

Who Do You Owe?

It’s easy to let some bills slip at the end of the year. Extra expenses in December may have caused you to run short on funds. Maybe you simply forgot, or you didn’t have a chance to deal with your payables. Whatever the reason, you can easily find out what bills you need to pay using QuickBooks.

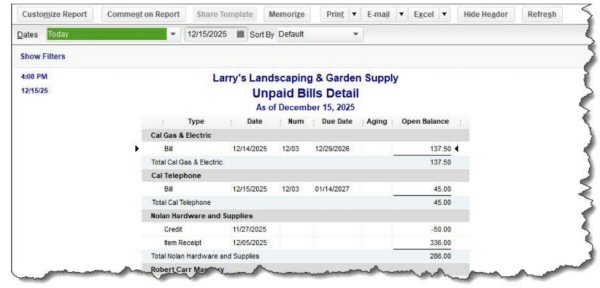

The first thing you should do is run an A/P Aging Detail report. Open the Report Center(Reports | Report Center) and click Vendors & Payables. Locate the report and click the green arrow button. When the report opens, click Customize Reporting the upper if you want to change the Dates. Then look to see if any bills are past due. Double-click on any row to see the original bill and pay it. You can also run the Unpaid Bills Detail report.

The Unpaid Bills Detail report

You’ve probably heard this before, but it’s important: If you’re past due on any bills, contact the vendors and let them know when they might expect payment. It makes a difference.

Who Owes You?

Just as you may have missed some bills in December, your customers might have let invoice payments slip. You need to find out who is in arrears. There are two reports that can help you here. Open the Report Center again and click Customers & Receivables. Run the A/R Aging Detail report and look at the Aging column to see if any customers have gone past due on payments. Open Invoices, too, can alert you to those customers.

How Should You Approach Past-Due Customers?

This is a problem for every small business. You don’t want to come on too strong and threaten the goodwill you’ve built up with your customers, but you have your own cash flow to consider. Here are some approaches:

- Set up payment reminders so you’ll remember to send follow-up emails. Go to Edit | Preferences |Payments | Company Preferences. Answer the questions under Payment Reminders.

- Automate reminders. Open the Customers menu and select Payment Reminders| Schedule Payment Reminders. This is a little complicated, so you may want our help with it. You’ll be creating schedules to automate the sending of invoices or statements at intervals you define. So you might dispatch an invoice to All customers when their payments are15 days after the due date, for example. Click Add reminder to see the default text for the email accompanying the invoice and edit it.